The Goods and Services Tax (GST) replaced most of the multiple indirect taxes and made the taxation system taxpayer-friendly. The GST Portal is the government‘s online platform which enables taxpayers to conduct various GST-based activities.

From GST registration to filing of returns, you can complete the entire process online via the GST Portal. This technological support allows you to avoid queuing up at local tax offices to pay taxes, view credit ledgers or claim tax refunds. You can also cancel your GST registration through this website.

The platform also allows you to carry out all communications about your GST compliance. You can track your registration and tax submission status. Moreover, you can receive intimation on and respond to government notices.

The first step to avail such facilities is to log in to the government’s official GST Portal. Here’s a review on the services you can access, along with the login procedure for first-time as well as existing GST payers.

What is the GST Portal?

To implement and oversee GST and administer GST, the government established the GST login portal. This is a website that permits taxpayers to use a variety of GST online. This GST portal allows taxpayers to sign up for GST and file tax returns to pay taxes, make refunds and access their tax information. This GST portal also offers information and instructions regarding GST laws and regulations, rates and procedures.

It is easy to sign into the official Government of India GST portal. This is a step-by-step guide for the GST login process for current as well as first-time users.

Services Available on GST Portal

The GST Portal provides various services including:

- GST Registration

- Filing GST Returns

- Payment of GST

- Viewing and tracking application status

- Claiming refunds

- Viewing notices and orders

- Updating profile information

How to get GST registration on GST Portal?

If your company generates an income that is greater than 40 lakhs in the selling goods, you need to be registered under GST. You can sign up on the official website. Go to www.gst.gov.in and under the “Services” tab you will see the “New Registration“ tab wherein you must follow the simple steps to get registered.

After the GST department approves the application, you’ll be issued the GST identification number (GSTIN). Additionally, you will be issued an GST account username (your GSTIN) and a temporary password.

How to Login to the GST Portal?

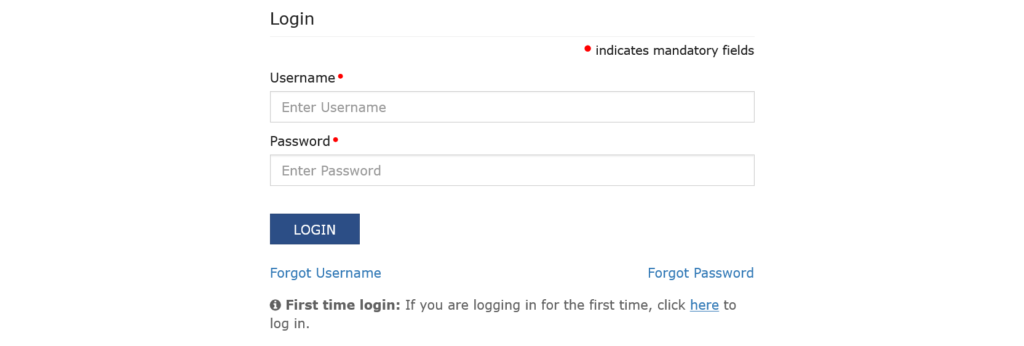

For first-time users, the GST Portal login steps are as follows:

- Visit GST Portal official website https://www.gst.gov.in/

- At the main page looking “Login” in menu

- Choose the “First-time login” option

- Input your provisional GST Portal login username and password and click “Login”

- Enter a new username and password that you want to use in the future

- Submit the form

You will go back to the Login page. Now you can log in with the username and password you created.

For existing users, the GST Portal login steps are as follows:

- Visit gst.gov.in

- Select the “Login” button located at the top right-hand corner of the screen

- Enter your username and password.

- Fill in the CAPTCHA code

- Click on “Login” again

You can access your dashboard after you login successfully and perform all GST-related tasks here.

How to login to the GST portal with TRN number?

To log in to the GST portal with a Temporary Reference Number (TRN), follow below the simple steps:

- Visit the GST portal and navigate to Services > Registration > New Registration.

- Select the Temporary Reference Number (TRN) option and input the TRN received.

- Enter the OTP sent to your registered email and mobile number, then click on Proceed.

What is the GST e-way bill?

Also known as electronic waybill also known as ‘electronic waybill‘ The electronic way bill is a document which transporters must be carrying when transporting items from one state to another state or in between states. The e-way bill aids in tracking movements of merchandise within GST.

You can create an electronic way bill through the portal for e-way bills. It is mandatory for any consignment of goods that is valued at Rs. 50000 or more.

If an electronic bill is created, an unique e-way bill number (EBN) is assigned to the recipient, the carrier and the supplier.

The following information or documents are needed to create an electronic bill of way:

- Invoice/bill of supply challan for the shipment of goods.

- The number of the transporter or vehicle in the event that the cargo is being transported via road.

- Transporter ID, document and the date printed at the bottom of the paper in case the shipment is transported via air, rail or ship.

Prior to GST introduction, waybills were produced through portals specific to states that were subjected to state regulations. With GST the electronic way bill is subject to the same set of rules that apply across India.

Related FAQs

What is GST?

GST, or Goods and Services Tax, is a comprehensive indirect tax levied on the supply of goods and services in India. It has replaced multiple indirect taxes like VAT, Service Tax, Excise Duty, etc. GST is a destination-based tax, meaning the tax is collected at the point of consumption.

What are the different types of GST?

There are four types of GST:

CGST (Central Goods and Services Tax)

SGST (State Goods and Services Tax)

IGST (Integrated Goods and Services Tax)

UTGST (Union Territory Goods and Services Tax)

Who needs to register for GST?

Any business whose turnover exceeds the threshold limit of Rs. 40 lakhs (Rs. 20 lakhs for special category states) in a financial year is required to register for GST.

How is GST calculated?

GST is calculated as a percentage of the transaction value. The applicable rate depends on the type of goods or services provided. The total GST amount is the sum of CGST and SGST (or UTGST) for intra-state supplies, and IGST for inter-state supplies.

What is the GST Portal?

The GST Portal (www.gst.gov.in) is the official website of the Goods and Services Tax (GST). It facilitates the registration, filing of returns, payment of taxes, and other compliance requirements related to GST.

How can I track my application status on the GST Portal?

To track the status of your application, log in to the GST Portal, go to the “Services” section, select “Track Application Status,” and enter your ARN (Application Reference Number). The status of your application will be displayed on the screen.

What should I do if I forget my GST Portal password?

If you forget your password, click on the “Forgot Username / Password” link on the login page, enter your GSTIN or provisional ID, and follow the instructions to reset your password using your registered email ID or mobile number.

How can I update my profile information on the GST Portal?

To update your profile information, log in to the GST Portal, click on your username at the top right corner, select “My Profile,” and then “Edit” to update your details. Make sure to save your changes before exiting.

| Read more Government Schemes | SSO Portal |